AMD Announces Q4 2016 Earnings

by Brett Howse on January 31, 2017 10:00 PM EST- Posted in

- CPUs

- AMD

- GPUs

- Financial Results

This afternoon, AMD announced their fourth quarter earnings for the 2016 fiscal year. 2016 was a challenging year for AMD, as they continue to expand their business away from only focusing on the PC market, and although they still have a long way to go, 2016 was an improvement on 2015. For Q4 AMD had revenues of $1.11 billion, which is up 15% from Q4 2015. Gross margin for the quarter was $351 million, up from $283 million a year ago. As a percentage, AMD’s gross margin was 32%, compared to 30% in Q4 2015. AMD had an operating loss of $3 million for the quarter, compared to a loss of $49 million a year ago, while net loss improved as well, from $102 million in Q4 2015 to $51 million this quarter. This resulted in a loss per share of $0.06, compared to a loss of $0.13 last year. AMD makes note that Q4 2016 was a 14-week quarter, compared to a 13-week quarter for Q3 2016 and Q4 2015.

| AMD Q4 2016 Financial Results (GAAP) | |||

| Q4'2016 | Q3'2016 | Q4'2015 | |

| Revenue | $1106M | $1307M | $958M |

| Gross Margin | 32% | 5% | 30% |

| Operating Income | -$3M | -$293M | -$49M |

| Net Income | -$51M | -$406M | -$102M |

| Earnings Per Share | -$0.06 | -$0.50 | -$0.13 |

For the full fiscal year, AMD had revenues of $4.27 billion, which is up 7%, but a sixth amendment to their wafer supply agreement hit their margins very hard in 2016. For the full year, AMD had margins of just 23%, which is a drop of 4% compared to 2015. Operating loss was $372 million for the year, compared to $481 million in 2015, and net loss was $497 million, compared to $660 million a year ago. For the full year, AMD had a net per share loss of $0.60, which is an improvement from the $0.84 loss in 2015.

AMD also reports Non-GAAP results, which exclude stock-based compensation, restructuring charges, node transition costs, and wafer agreement charges, to give a look at their core business. On a Non-GAAP basis, AMD had revenues of $1.11 billion, just like their GAAP numbers, but they posted operating income of $26 million for the quarter, compared to an operating loss of $39 million a year ago. Net loss was $8 million, compared to $79 million in Q4 2015, and loss per share was $0.01 compared to $0.10 a year ago.

| AMD Q4 2016 Financial Results (Non-GAAP) | |||

| Q4'2016 | Q3'2016 | Q4'2015 | |

| Revenue | $1106M | $1307M | $958M |

| Gross Margin | 32% | 31% | 30% |

| Operating Income | $26M | $70M | -$39M |

| Net Income | -$8M | $27M | -$79M |

| Earnings Per Share | -$0.01 | $0.03 | -$0.10 |

AMD attributes their increase in revenue primarily due to increased GPU sales. AMD’s Computing and Graphics segment had revenues for the quarter of $600 million, which is up 28% year-over-year. Polaris seems to be doing quite well, which is great to see. The segment still had an operating loss of $21 million, but that is a big improvement from the operating loss of $99 million a year ago. CPU average selling price fell year-over-year, but GPU average selling price increased year-over-year, thanks to higher desktop and professional graphics pricing. We eagerly await the launch of Ryzen, which AMD showed off last quarter, and expect to hear more about it this quarter.

| AMD Q4 2016 Computing and Graphics | |||||

| Q4'2016 | Q3'2016 | Q4'2015 | |||

| Revenue | $600M | $472M | $470M | ||

| Operating Income | -$21M | -$66M | -$99M | ||

AMD branched into Enterprise, Embedded, and Semi-Custom designs and it has proven to be a strong source of revenue for them. With wins in both the Xbox One and PlayStation 4, AMD continues to be the beneficiary of both of those consoles outselling their predecessors. For Q4, this segment had revenue of $506 million, which is up 4% year-over-year, thanks to higher embedded and semi-custom SoC revenue. This segment does have it’s ups and downs annually with consoles peaking and ebbing, but annually it has been a strong market for AMD to branch into. This segment had an operating income of $47 million for the quarter, which is down from $59 million a year ago, which AMD attributes to higher R&D investments this quarter.

| AMD Q4 2016 Enterprise, Embedded, and Semi-Custom | |||||

| Q4'2016 | Q3'2016 | Q4'2015 | |||

| Revenue | $506M | $835M | $488M | ||

| Operating Income | $47M | $136M | $59M | ||

Finally, All Other had an operating loss of $29 million, compared to $9 million a year ago. The increased loss is attributed to higher stock-based compensation charges for Q4 2016.

AMD had strong margins for this quarter, and if they are going to have a strong 2017, that needs to be their focus. Ryzen may help as well, depending on how it compares, but Dr. Lisa Su, AMD’s president and CEO, has been slowly but surely bringing AMD back to a point of profitability. Looking ahead, AMD expects revenues to decrease 11% for next quarter, plus or minus 3%, which would put them at an 18% increase in revenue for Q1 2017 compared to Q1 2016, if you pick the mid-point in their target.

Source: AMD Investor Relations

34 Comments

View All Comments

Dribble - Wednesday, February 1, 2017 - link

Mostly looks slightly better because they took all of their one-off-but-happens-every-year GF fine in the 3rd quarter. If you spread that over the year then every quarters margins are rubbish.fanofanand - Wednesday, February 1, 2017 - link

Your comment is rubbish. Margins have NOTHING to do with their agreement with GloFo.Dribble - Wednesday, February 1, 2017 - link

So the Gross Margin of 5% in Q3 2016 as a result of having to pay GF all that money didn't happen then?You can't say margins are growing when you have a 5% margin in one quarter, especially as that expense wasn't for GF purchases for that quarter only so really should have been spread over all of them.

beck2050 - Wednesday, February 1, 2017 - link

Still losses for the quarter and the year.TheinsanegamerN - Wednesday, February 1, 2017 - link

but losses are far lower this year then last year. It's still a huge improvement.Mondozai - Wednesday, February 1, 2017 - link

So they are cutting their losses in half and are seeing healthy revenue growth. Give Lisa a year more or two and AMD will finally be back on firmer footing.Meteor2 - Wednesday, February 1, 2017 - link

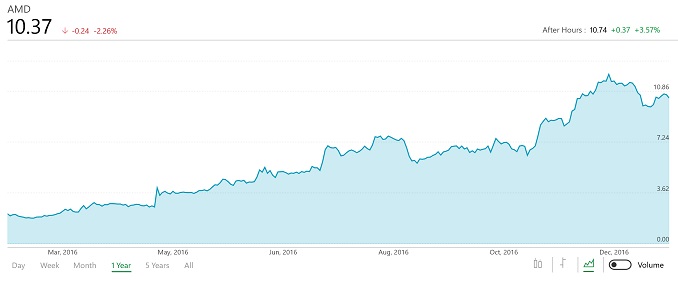

Just look at that share price -- it's, what tripled in 12 months? I rather wish I'd bought some...TheinsanegamerN - Wednesday, February 1, 2017 - link

me too. but it's not too late. I've been buying some in anticipation of AMD's stock ryzing (heh) soon. Between vega and ryzen, its going to be a good year for AMD.fanofanand - Wednesday, February 1, 2017 - link

Unfortunately I think Ryzen being a success has already been baked into the share price. When Ryzen releases, assuming it has something close to parity with Intel, then the stock price will drop by probably 25% as profit-taking occurs. If Vega is awesome, and Ryzen sales are brisk then you will see a recovery in the later part of the year. Buying now, in my opinion, would be foolish.Meteor2 - Wednesday, February 1, 2017 - link

Yeah indeed. Buy low sell high. Too high a possibility you're quite right and the only way is down if Zen falls short.