NVIDIA Nerfs Ethereum Hash Rate & Launches CMP Dedicated Mining Hardware

by Ryan Smith & Dr. Ian Cutress on February 18, 2021 9:45 AM EST

One of the critical points during this period of high demand for graphics cards is that a portion of them are being purchased by professional users looking to mine cryptocurrencies. The recent launch of new cards coupled with record highs in the cryptocurrency market has led to a rebirth of the mining community, who as of recently could earn ~$15/day per RTX 3090 graphics card. These professional miners buy graphics card by the pallet load, sometimes bypassing retailers and going direct to distributors, as they can guarantee a complete shipment sale in one go. The knock on effect is fewer cards available for gamers looking to build new systems, leading to empty shelves and causing prices to spike for the handful of cards that ever make it to retailers.

In order to at least offer a fig leaf to gamers, in the past certain graphics board partners started producing mining-only graphics cards. These had no graphical outputs, making them almost impossible for gaming use cases, but it filtered off some of the mining market into buying those rather than taking stock away from shelves for gamers. This was a poor band-aid, and now NVIDIA has gone one step further to separate mining from gaming.

NVIDIA’s announcement today is two-fold: firstly addressing the upcoming launch of the RTX 3060 graphics on February 25th, and secondly announcing a new range of dedicated mining hardware.

RTX 3060: Halving the Mining Rate

One of the key drivers as to why the new graphics cards are being sold is because they are so good at doing the mining operations for various cryptocurrencies (namely for Ethereum and other derived coins) and earning the users a semblance of return on their purchase. Mining requires hardware and software, and it’s the software side that NVIDIA is tackling with this first announcement.

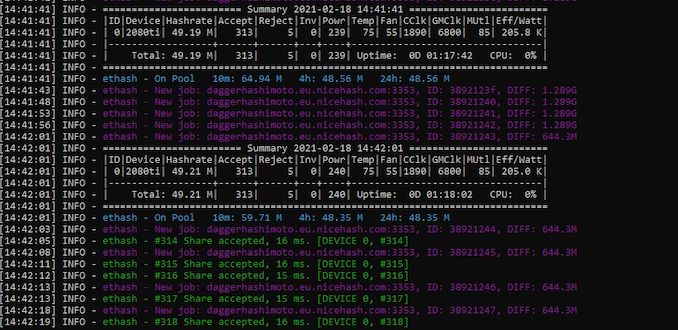

For the upcoming RTX 3060, the software drivers for this graphics card will automatically limit cryptocoin hashing rates to half – making how much they can earn specifically halved. The software drivers will do this by detecting the math coming through the pipeline and restricting access to the hardware for those operations. At this point we’re not sure if it’s a cut in frequency that the drivers will cause or simply limiting the operations to half of the hardware, but either way NVIDIA is hoping this will detract professional miners from buying these cards if the return on them is halved.

Update: NVIDIA has also confirmed that performance restrictions will be going in for their Linux drivers as well as their Windows drivers. The inclusion of Linux drivers is incredibly important, as most dedicated miners are thought to be using Linux rather than Windows.

No plans are being announced for cards currently in the market, perhaps because the drivers for those cards already allow a full-rate compute solution, and those can simply keep older drivers installed.

NVIDIA CMP: Dedicated Mining Silicon for Ethereum

In the same way that ‘crypto’ cards without video outputs were pushing into the market for balance, NVIDIA is going a step further and removing the video outputs from the silicon entirely. There are other potential optimizations that could be made for power and performance, but at this point NVIDIA is simply stating as graphics-less silicon. This could be a mix of customized new silicon, or simply silicon already manufactured that had defects in the video output pipeline.

The new NVIDIA CMP HX dedicated mining cards will come in four variants up to 320 W, and from authorized partners including ASUS, Colorful, EVGA, Gigabyte, MSI, Palit, and PC Partner. These cards (along with drivers) are also set to be designed such that more of these cards can be enabled in a single system.

| NVIDIA CMP HX Mining Hardware | ||||

| AnandTech | 30HX | 40HX | 50HX | 90HX |

| Eth Hash Rate* | 26 MH/s | 36 MH/s | 45 MH/s | 86 MH/s |

| Rated Power | 125 W | 185 W | 250 W | 320 W |

| Reference Connectors | 8-pin | 8-pin | 2 x 8-pin | 2 x 8-pin |

| Memory Size | 6 GB | 8 GB | 10 GB | 10 GB |

| Availability | Q1 | Q1 | Q2 | Q2 |

| *NVIDIA Measured to DAG and Epoch 394 | ||||

What’s interesting here is that these stats aren’t that great. Here is a breakdown of what NVIDIA’s cards do today, and you can see why:

| NVIDIA Hardware Hash Rates | |||

| AnandTech | Hash Rate | Power | Efficiency MH/s/W |

| RTX 3090 | 121 MH/s | 290 W | 0.42 |

| RTX 3080 | 98 MH/s | 224 W | 0.44 |

| 90HX | 86 MH/s | 320 W | 0.27 |

| RTX 3070 | 62 MH/s | 117 W | 0.53 |

| RTX 3060 Ti | 60 MH/s | 120 W | 0.50 |

| RTX 2080 Ti | 49 MH/s | 240 W | 0.20 |

| 50HX | 45 MH/s | 250 W | 0.18 |

| 40HX | 36 MH/s | 185 W | 0.19 |

| 30HX | 26 MH/s | 125 W | 0.21 |

| HX Data from NVIDIA RTX Data from Minerstat |

|||

The only way these new CMP HX mining add-in cards make financial sense is if they are really cheap, around $600 for the 90HX, otherwise the retail gaming GPUs seem to be a lot more efficient.

NVIDIA isn’t giving any more details on when these mining add-in cards will be made available, aside from Q1 for the slower ones and Q2 for the faster ones. No word on pricing, nor on distribution methods – there’s a chance here that these cards will only be sold by distributors direct to professional mining outlets. By the pallet. Note that this doesn’t stop the high demand for power supplies. That market is also feeling the effects.

Analysis: Will This Work?

NVIDIA’s actions come as Ethereum mining has essentially broken the retail market for GPUs for the last few months – and quite possibly will keep it broken for months to come. And while selling every last GPU they can make is hardly a bad thing for NVIDIA in the short term, in the long term a broken market risks hurting NVIDIA’s brand and consumer customer base, never mind the threat of all of those mining cards boomeranging back once the bubble pops (again). All of which raises a very important question: will this work?

For better or worse, nothing NVIDIA is doing today will fundamentally change the market forces at work. So long as Ethereum is running over $1000 or so, miners can make a tidy profit using video cards for mining – and thus miners value the hardware more than gamers. NVIDIA can nudge things in one direction or another, but even NVIDIA isn’t going to be able to beat the laws of supply and demand. As a result, the problem at hand won’t truly go away until either mining stops being profitable, either by Ethereum’s price coming down or the market being flooded with cards (and thereby spiking the difficulty level).

In the interim, the best NVIDIA can do is to try to keep miners from snatching up consumer video cards, which is what today’s announcement focuses on. There’s every reason to believe that miners will end up with the bulk of GPUs – this is market forces at work; miners pay more – but if NVIDIA can at least ensure that the fastest video card in stock at Newegg is better than a GT 1030, then that’s a big improvement over where things stand today.

Making consumer GeForce cards less palatable to miners is certainly going to be the most important step of this, though it’s unfortunately also the hardest to execute on. Detecting Ethereum is easy enough, but because the block is being done at the driver level, it’s also extremely vulnerable to being patched out. Miners only need to hack one driver, and then every RTX 3060 card from here-on out can be used for mining by using that driver. NVIDIA is essentially implementing driver-based DRM, which historically has not worked out all that well over the long-run.

A few more details on NVIDIA's Ethereum rate limiter, straight from NV PR: https://t.co/XGnXKCaIG6

— Ryan Smith (@RyanSmithAT) February 19, 2021

Which isn’t to say that the driver throttling approach won’t work. But there is a very real chance it’s not going to work for very long, especially with miners so financially motivated to work-around it. Complicating matters, NVIDIA has been shipping mobile RTX 3060 hardware and drivers since late January as part of the RTX 30 series for laptops, so driver hackers already have a starting point for “clean” GA106 code.

As an aside, this is also why NVIDIA can’t do anything about the existing RTX video cards already on the market. Even if NVIDIA puts Ethereum throttling code into future drivers, miners can just use the existing drivers. In other words, NVIDIA can’t put the genie back into the bottle; they can only try to keep any more genies from getting out.

Which is why the second aspect of NVIDIA’s strategy – introducing a line of dedicated mining cards – is more likely to have a lasting impact. Even though it probably won’t help with either the supply of consumer video cards nor the high demand for them, it at least will help NVIDIA manage how many cards are offered to consumers versus miners.

I won’t try to ascribe too much to NVIDIA’s specific motivations here, but at the end of the day NVIDIA has built an empire on very rigidly defined market segmentation, so siphoning off miners into their own category plays to NVIDIA’s strengths. Along with more specific control over product allocations, mining-only cards allows NVIDIA to price those cards as the market will bear, all without disrupting the consumer market. And, perhaps most importantly NVIDIA, mining-only cards won’t boomerang back into the used video card market once the bubble does pop. The resulting crypto-hangover from the last time that happened significantly hurt NVIDIA (and AMD), so they’re going to be eager to avoid it.

But will miners buy mining-only cards? That’s a more nebulous question. The ability to offload used cards into the arms of gamers is a significant part of the financial calculus for miners, because it means their hardware investment doesn’t become worthless overnight. Consequently, mining-only cards are not nearly as desirable. On the other hand, given how hard it is to get any video cards right now, even a mining-only card is better than nothing if you want to start mining for profit today. Currently, miners are taking virtually everything they can get, and certainly NVIDIA seems to be counting on that to continue.

Ultimately, introducing mining-only cards is likely to be the more successful half of NVIDIA’s announcement today. It’s clear that the mining market isn’t going away any time soon, and until it does, it’s in NVIDIA’s own interests to try to control it so that it doesn’t continue to wreak havoc on the consumer video card market.

As for consumers looking to get a video card for gaming purposes, today’s announcement is probably a bit of a wash. It certainly doesn’t hurt that NVIDIA is trying to get better control over the market and drive miners away from consumer video cards; it’s just not likely to stop them entirely given the profits at hand. Put another way, I don’t realistically expect that the RTX 3060 will be any more available than NVIDIA’s other RTX cards; but I will give NVIDIA some credit for trying with today’s announcement. If nothing else, today is a first step towards a long-term solution for what may end up being a long-term problem.

Related Reading

- NVIDIA’s GeForce RTX 3060 Gets a Release Date: February 25th

- NVIDIA Reveals GeForce RTX 3060: Launching Late February For $329

- The NVIDIA GeForce CES 2021 Live Blog: Game On

- Launching This Week: NVIDIA’s GeForce RTX 3060 Ti, A Smaller Bite of Ampere For $400

- Launching This Week: NVIDIA’s GeForce RTX 3070; 1440p Gaming For $499

- NVIDIA Announces the GeForce RTX 30 Series: Ampere For Gaming, Starting With RTX 3080 & RTX 3090

131 Comments

View All Comments

DanNeely - Thursday, February 18, 2021 - link

For bitcoin like applications yes. But etherium was designed to prevent that sort of hyper-focused hashing; GPUlike compute cores and lots of GDDR is the most efficient way to mine it. At least one of the big BC mining companies designed an ether asic; but AFAIK never brought it to market because the upfront costs would exceed the marginal gains they could get vs just buying from AMD/NVidia. If future GPUs increase their share of RT cores, that calculus might change; OTOH etherium is planning to move away from compute based mining so... ¯\_(ツ)_/¯(And going farther down the process behind etheriums design are coins like monero that are only CPU minable. IIRC they need a ton of ram/core.)

Leeea - Thursday, February 18, 2021 - link

Even cutting the hash rate in half, it is still a massively profitable card. This sounds good and does nothing.As for the bypass, it will likely happen via custom bios. Most likely be flashing the card with a modified 3070 bios, to trick the driver.

drexnx - Thursday, February 18, 2021 - link

nvidia has used signed bioses since Pascal came out, Maxwell was the last architecture you could bios mod without the keys.Leeea - Thursday, February 18, 2021 - link

That is interesting, I did not know that.Then it will likely be a driver hack. Or just not bother, the card looks sadly profitable even at 1/2 mining speed.

euskalzabe - Thursday, February 18, 2021 - link

This, precisely. It'll be really hard for any miner, regardless of resources, to successfully install a custom BIOS.Silver5urfer - Thursday, February 18, 2021 - link

Did you see how much time it will take to make it break even ? "Massively Profitable" lolhttps://www.tomshardware.com/best-picks/best-minin...

In short they take a LONG time, but the pallets and pallets of selling with the damn PSUs and farms it makes a huge thing. That's the key here.

And even hating the Cryptobs so hard but I do not like the approach Ngreedia is doing, nerfing the GPUs is not good in any way, today it's this tmrw it will be another segementation bullcrap.

DanNeely - Thursday, February 18, 2021 - link

The big miners are buying directly from NVidia/card makers; their breakeven times are a lot faster because they're not paying scalper rates.nunya112 - Thursday, February 18, 2021 - link

maybe they need to block it at the hardware level remove the actual instruction ?? perhaps ??b0g4rt - Thursday, February 18, 2021 - link

Will caveat that I do own and use p106-100's (I picked them up during a low interest period from a mine that was shuttering a part of their gpu portion). Regardless any fab being used to produce a new crypto segment is not for the benefit of pc gamers, its simply another cash grab. If the HX cards aren't a good ROI miners will continue to buy the retail gpus & workstation cards because they can simply use firmware & drivers that mitigate what nVidia places in newer drivers. The lesson to learn in 2017 & 2018 was that gamers should be benefitting from unused clock cycles by conducting proof of work for a crypto network since it easily can pay for current/newer components. The lesson that needs to be learned from the current logistical predicament is not by miners (who are simply finding solutions that are available in a free market), nor gamers (who are never at fault in this conversation), but retail sellers who should have from the on-set treated this like toilet paper during the early pandemic (1-2 per customer & keep a rolling ledger of who has purchased), better api mitigations for auto-buying/bots, etc.Spunjji - Friday, February 19, 2021 - link

Indeed - hell, they could even have passed the extra admin costs onto the consumer (and then some). What's an extra $20 per card vs. several hundred in markup from a scalper. But it seems like most retailers preferred the easy route of shifting as much stock as possible as fast as possible.