AMD Set to Be Added to NASDAQ 100 Index

by Anton Shilov on December 20, 2018 11:25 AM EST- Posted in

- CPUs

- AMD

- GPUs

- Financial Results

AMD on Thursday announced that it would be added to the NASDAQ 100 index of non-financial companies next week. The chip company will be added to the list due to its increased market capitalization, which is a result of successful launches of its Ryzen and EPYC processors as well as a regular product roadmap and cadence.

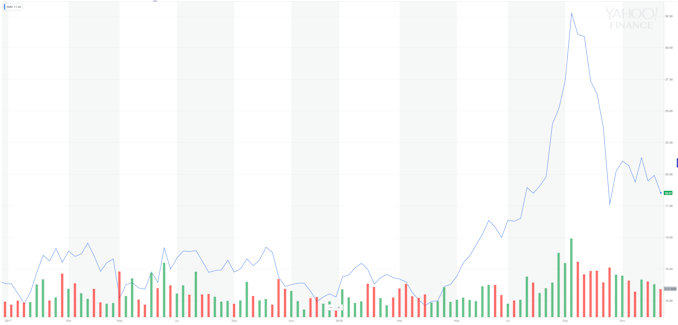

The price of AMD’s stock has increased by nearly two times since mid-January 2017: from $9.75 per share to $18.49. As a result, AMD’s market capitalization at press time was $18.54 billion (based on data from Yahoo Finance). After reporting $1.653 billion in revenue and $102 million in net income for Q3 2018, the company has $1.06 billion in cash and has about $1.3 billion dollars in outstanding debts, gradually being paid back.

What is perhaps more important than the most recent financial results is that AMD’s gross margins reached 40%. The company’s margins increased primarily because AMD can now compete against Intel in high-performance and high-margin desktops as well as servers. Virtually all leading suppliers of PCs and servers have introduced machines based on the Ryzen and EPYC CPUs. The latter are now offered by cloud providers, such as Amazon and Oracle. The company yet has to gain increased share inside notebooks, yet investors seem to be optimistic about its prospects.

AMD’s addition to the NASDAQ 100 index will become effective when the market opens on Monday, December 24, 2018.

“2018 has been another exciting year for AMD as we delivered new high-performance computing and graphics products for the gaming, PC and datacenter markets,” said Ruth Cotter, senior vice president, Worldwide Marketing, Human Resources and Investor Relations. “Joining the NASDAQ-100 Index further demonstrates the progress we’ve made in recent years to transform the company, execute our long-term strategy and deliver a robust product and technology roadmap.”

Related Reading:

- Naples, Rome, Milan, Zen 4: An Interview with AMD CTO, Mark Papermaster

- AMD Announces Q3 FY 2018 Earnings: Improving Margins, But Dogged By Crypto Decline

- AMD's CEO Dr. Lisa Su to Host a CES 2019 Keynote: 7nm CPUs and GPUs

- Mike Rayfield, General Manager of AMD’s RTG, to Resign by Year’s End

- AMD Previews EPYC ‘Rome’ Processor: Up to 64 Zen 2 Cores

- AMD Unveils ‘Chiplet’ Design Approach: 7nm Zen 2 Cores Meet 14 nm I/O Die

- AMD Announces Zen 4 Microarchitecture Under Development

- AMD’s EPYC CPUs Now Available on Amazon Web Services

- Oracle puts AMD EPYC in the Cloud

Source: AMD

15 Comments

View All Comments

Opencg - Thursday, December 20, 2018 - link

Everything does look on track and somewhat cohesive for the company. Navi is comming at the perfect time. It should offer reduced cost of production. And considering the turing is the opposite that means that at any performance mark navi can meet it will outclass turing in performance per dollar. The only question is will it contest the top or only the middle ground?You look at financial reports and they talk about the crypto mining boom and use that to justfy the numbers. But every time you look at the numbers they have a direct correlation to price/performance ratios in graphics cards. You have to understand that that is the bottom line and the sales figures are hardly unpredictable. People buying the cards for mining are often gamers. And nobody gamer or pro or miner wants a bad deal. Right now the deals are bad BY DESIGN by nvidia. This is not something they can reverse they just engineered chips that cost more and do less. Navi uses dramatically improved yields to reduce cost. Even on its own the outcome of navi looks optimistic by itself. But in light of nvidias biggest blunder in their history I'd say that yeah amd looks pretty fucking good right NOW before people start realizing what is going to happen to the gpu market in late 2019.

Matthmaroo - Thursday, December 20, 2018 - link

I have almost always bought NVIDIABut they have lost their minds with pricing

Opencg - Friday, December 21, 2018 - link

Yeah me to. Ge force 4 ti, 6800 gtx, 570, 980m, 1070. Loved the cards and loved the company. Can't believe they made such a big decision that was such an obvious failure by design. Got my fingers crossed for amd cards otherwise I just wont be buying a gpu anytime soon.DanNeely - Thursday, December 20, 2018 - link

What company fell off the index to make the opening AMD took?WithoutWeakness - Thursday, December 20, 2018 - link

https://en.wikipedia.org/wiki/NASDAQ-100#Changes_i...Looks like 6 stocks (including AMD) are being added and thus 6 are being taken off the index. Interestingly, Seagate Technologies is one of the ones being removed.

HStewart - Thursday, December 20, 2018 - link

It is funny Electronic Art and Telsa are also on list and they both have problems - at least from customersHStewart - Thursday, December 20, 2018 - link

No wonder Seagate was removed - they are struggling because of switch from physical to ssd drivesSamus - Friday, December 21, 2018 - link

I think Seagate was incredibly late to the SSD game. WD was more forward thinking.Seagate datacenter products have also fallen out of favor to WD over the years. Seagate still has strong OEM and consumer presence but that isn't as profitable.

thesavvymage - Thursday, December 20, 2018 - link

problems from customers have absolutely zero to do with inclusion status on a stock index...Samus - Friday, December 21, 2018 - link

Yeah is customer satisfaction and quality mattered to NASDAQ there is no way in hell FCAU would be on the ticker.