SanDisk To Acquire Fusion-io

by Kristian Vättö on June 16, 2014 9:50 AM EST

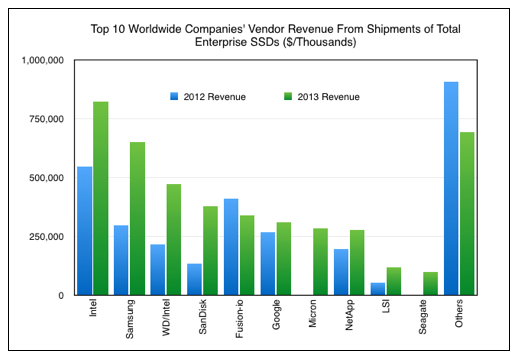

It looks like the SSD industry is going through some serious consolidation. Only a couple of weeks ago, Seagate announced that they have acquired LSI's flash division (i.e. SandForce) from Avago and today SanDisk announced that they will be acquiring Fusion-IO for $1.1 billion cash. Fusion-IO focuses on enterprise flash products (both hardware and software) and is probably one of the most iconic enterprise SSD companies because Facebook has been one of their major revenue sources for years and of course having Steve Wozniak as the Chief Scientist has given Fusion-io a lot of publicity as well.

I think this acquisition further reinforces the point that companies without a NAND fab are in trouble. Fusion-io's advantage in the market was their early entry, which allowed them to build a good customer base before the likes of Intel and Samsung started to take SSDs seriously. However, now it's hard for Fusion-io and other fabless companies to stay price competitive because the companies with NAND plants can always undercut their prices as ultimately Fusion-io buys their NAND from the companies that are their biggest rivals in the SSD market. Obviously, the NAND manufacturers are looking to make profit from the NAND they sell, so the price battle is one that Fusion-io and the others can't win in long-term. SanDisk has a NAND joint-venture with Toshiba, so this acquisition gives Fusion-io a direct access to NAND.

Source: Gartner HWQ via TheRegister.co.uk

As for SanDisk, their enterprise solutions have been a bit tame compared to Samsung and Intel. SanDisk has a vertical integration model but for some reason their enterprise products just haven't had the same momentum. SanDisk did manage to increase their enterprise SSD revenue significantly in 2013 but they must be able to keep up the growth. With Fusion-io's existing revenue sources and SanDisk's vertical integration business model, SanDisk should definitely have the ammunition to challenge Intel and Samsung in the enterprise space.

SanDisk is hosting a conference call later today, so stay tuned for updates. The press release doesn't specify whether Fusion-io will be integrated into SanDisks's enterprise storage unit but we should know more after the conference call. This is certainly one of the biggest news in the history of enterprise SSDs given that SanDisk and Fusion-io were the number four and five in revenue last year, so I'm very excited to see how it plays out.

Source: SanDisk PR

12 Comments

View All Comments

moridinbg - Monday, June 16, 2014 - link

What times do we live in! So many articles about NAND on anand!Roland00Address - Monday, June 16, 2014 - link

Google makes enterprise ssds? Am I reading that chart correctly?I understand you are not the source of the chart ( Gartner HWQ via TheRegister.co.uk) is, but is their similar info for not enterprise ssds, OEM and retail?

Kristian Vättö - Monday, June 16, 2014 - link

Google is a bit different from the others. Their reported revenue is based on the revenue they generate from SSDs in their internal use (e.g. Google Compute Engine offers an option for SSD-only storage). In other words, Google doesn't ship any SSDs under their own brand, although they may be using in-house designed SSDs (they don't disclose any details of the SSDs they use).jjj - Monday, June 16, 2014 - link

You are kinda missing the point. Sandisk bought a bunch of SSD related companies , they hired new execs and even your graph is showing a huge growth. They bought Pliant for SAS ,now they cover PCI, they are going at rather furious pace and their overall SSD revenue is quite significant.They are also the only player that is just NAND, they live or die by it so they are more focused than others.Kristian Vättö - Monday, June 16, 2014 - link

They are growing, yes, but they are behind in technology. SanDisk doesn't have an NVMe PCIe drive while both Samsung and Intel do. Their only PCIe SSD, the Lightning, is two years old. That's ancient by today's standards. Their SAS drives are pretty good thanks to Pliant but PCIe is the high growth market that SanDisk needs to strike if they want to continue growing at ~100% year over year.Being NAND-only doesn't give them any significant advantage. It's not like Samsung's memory division is ran by the same guys as their refrigerator division. Both Intel and Samsung are heavily invested in SSDs and are focused on what they do. In the end, it's another revenue source for them, so as long as it's profitable they'll care about it.

FunBunny2 - Monday, June 16, 2014 - link

The notion that any of the companies mentioned are "enterprise" SSD companies is baloney. Texas Memory, now inside IBM, and a host of small (mostly private) is the archetype for enterprise SSD. So far. Here is a very good site for following SSD across the gamut of clients: http://www.storagesearch.com/To the extent that SSD's future history mirrors HDD, in that enterprise drives become just higher binned commodity drives (anybody remember the 3390?), then claiming enterprise status for the likes of Intel/Samsung/ScanDisk/etc. isn't ridiculous. So far, it is.

Kristian Vättö - Monday, June 16, 2014 - link

Two different products. The likes of IBM, Pure Storage and EMC sell Solid State Arrays while Intel, Samsung and SanDisk sell Solid State Drives. The actual drives that the array guys use usually come from the SSD manufacturers.Kevin G - Monday, June 16, 2014 - link

Traditionally this hasn't been the case. I know that some of Texas Memory System's products were designed in house. In particular, they've used RAID3 internally in their products and that's pretty much the only instance I've seen RAID3 used in a production environment.Then again, they've launched several new products under the IBM umbrella this year so things may have changed.

Guspaz - Monday, June 16, 2014 - link

Seagate doesn't have a NAND fab (or a close partnership), right? I'm thinking that even buying Sandforce from LSI won't help them become a serious player if they don't have their own NAND.jhh - Monday, June 16, 2014 - link

SanDisk also bought SmartStorage a while ago, which makes flash on a DDR3 socket. There will be some interesting dynamics between the two. SmartStorage has an interesting technology to maximize write cycles, as flash is usually rated for the weakest cells, while most of the other cells could support more write cycles. I wonder if that technology will make it into Fusion-io.