Intel's Process Roadmap to 2025: with 4nm, 3nm, 20A and 18A?!

by Dr. Ian Cutress on July 26, 2021 5:00 PM ESTSidebar on Intel EUV

In all of these announcements, one thing to highlight is Intel mentioning its relationship with ASML, the sole company that manufactures the EUV machines powering production of leading edge semiconductor manufacturing.

ASML is a unique company in that it is the only one that can produce these machines, because the technology behind them is often tied up with its partners and research, but also because all the major silicon manufacturers are heavily invested in ASML. For any other company to compete against ASML would require building a separate network of expertise, a decade of innovation and design, and a lot of capital. None of the major silicon vendors want to disturb this balance and go off on their own, lest it shuts them out of the latest manufacturing technology, and no research fund sees competing against the embedded norm as a viable opportunity. This means that anyone wanting EUV specialist technology has to go to ASML.

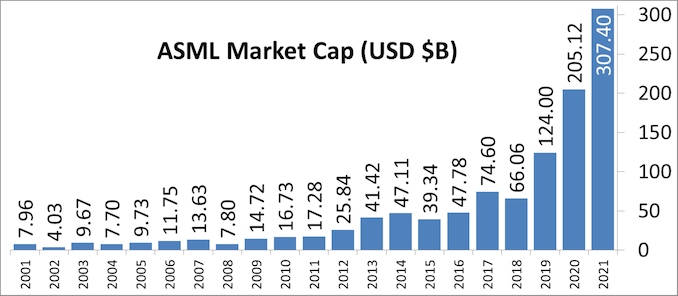

In 2012, it was reported that Intel, Samsung, and TSMC all invested in ASML. This was, at the time, to jumpstart EUV development along with migrating from 300mm wafers to 450mm wafers. While we haven’t moved to 450mm wafers yet (and there are doubts we will any time in the next decade), EUV is now here. Intel’s 2012 investment of $2.1 billion gave them a 10% stake in ASML, with Intel stating that it would continue investing up to a 25% stack. Those stakes are now below the 5% reporting threshold, but all three of the major foundry customers are still big owners, especially as ASML’s market cap has risen from $24 Billion in 2012 to $268 Billion in 2021 (surpassing Intel).

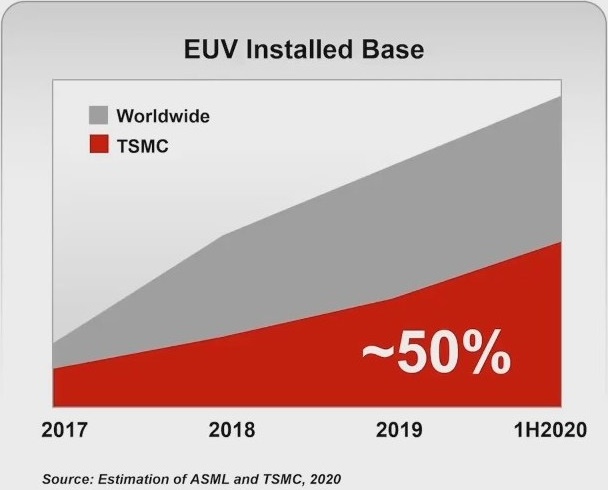

As major investors but also ASML’s customers, the race has been on for these foundries to acquire enough EUV machines to meet demand. TSMC reported in August 2020 that it has 50% of all EUV machines manufactured at ASML for its leading edge processes. Intel is a little behind, especially as none of Intel’s products in the market yet use any EUV. EUV will only intercept Intel’s portfolio with its new Intel 4 process, where it will be used extensively, mostly on the BEOL. But Intel still has to order machines when they need them, especially as there are reports that ASML currently has backorders of 50 EUV machines. In 2021, ASML is expected to manufacture around 45-50 machines, and 50-60 in 2022. The exact number of machines Intel has right now, or has ordered from ASML, is unknown. It is expected that each one has a ~$150m price tag, and can take 4-6 months to install.

With all that being said, Intel’s discussion point today is that it will be the lead customer for ASML’s next generation EUV technology known as High-NA EUV. NA in this context relates to the ‘numerical aperture’ of the EUV machine, or to put simply, how wide you can make the EUV beam inside the machine before it hits the wafer. The wider the beam before you hit the wafer, the more intense it can be when it hits the wafer, which increases how accurately the lines are printed. Normally in lithography to get better printed lines, we move from single patterning to double patterning (or quad patterning) to get that effect, which decreases yield. The move to High-NA would mean that the ecosystem can stay on single patterning for longer, which some have quoted as allowing the industry to ‘stay aligned with Moore’s Law longer’.

| ASML's EUV Shipments | |||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |||||||||||||||

| Actual | 2 | 4 | 10 | 3 | 4 | 5 | 6 | 4 | 7 | 7 | 8 | 4 | 7 | 14 | 8 | 7 | 9 | - | - | ||

| Target (Total) | - | - | - | 20 (18) | 30 (26) | 35 (33) | 45-50 | ||||||||||||||

| 2018 and beyond is split per quarter for actual shipped numbers Data taken from ASML's Financial Reports |

|||||||||||||||||||||

Current EUV systems are NA 0.33, while the new systems are NA 0.55. ASML’s latest update suggests that it expects customers to be using High-NA for production in 2025/2026, which means that Intel is likely going to be getting the first machine (ASML NXE:5000 we think) in mid-2024. Exactly how many High-NA machines ASML intends to produce in that time frame is unknown, as if they flood the market, having the first won’t be a big win. However if there is a slow High-NA ramp, it will be up to Intel to capitalize on its advantage.

326 Comments

View All Comments

KAlmquist - Monday, July 26, 2021 - link

The reason ASML is switching to High-NA EUV is diffraction. Diffraction makes an image blurry, and increasing the aperture of a lens decreases the amount of diffraction.Photographers normally measure apertures in terms of “f-stops” rather than “numerical aperture.” The current ASML EUV machines have an aperture of f/1.5, while the high-NA machines will have an aperture of f/0.91.

Spunjji - Thursday, July 29, 2021 - link

Thanks for that - I did wonder what it corresponded to! I know there are other engineering and optical issues that creep in with wider apertures, so I'm guessing that's what's preventing them switching to High-NA sooner.JayNor - Monday, July 26, 2021 - link

Pat's statement that Alder Lake uses advanced packaging seems to be news. Did he just mean to say Meteor Lake?Rudde - Tuesday, July 27, 2021 - link

Alder Lake was said to use Foveros when announced. Foveros is advanced packaging.JoeDuarte - Monday, July 26, 2021 - link

I think it's doubtful that we'll ever see these nodes. It's certainly unlikely that Intel will deliver them on schedule, even though the schedule is now several years behind their original promises.It would be very interesting to see some rigorous organizational research on how some foundries are able to reliably advance with new nodes and shrinks, while others fail. It's a complete mystery to me how TSMC is able to reliably advance on schedule, moving the threshold of the physics and engineering, but Intel is simply unable to do the same. It's not clear what is different in terms of process, talent, organization, etc. Does TSMC have secret discoveries in engineering management? Is it possible for companies to decide to hit a node and then hit that node? What makes it work for some and not others?

Whatever the reasons, it looks like Intel is simply unable to advance. They've been treading water for many years now. It's been a long time since they did anything major. If not for TSMC, it would make me think that the physics just didn't work for any more shrinks.

Machinus - Tuesday, July 27, 2021 - link

Taiwan is smart enough to invest it its industry, and TSMC is smart enough not to waste all of its retained earnings on shareholders. Research project done.TheinsanegamerN - Tuesday, July 27, 2021 - link

If someone tells you to "reasearch" anything to support their argument, their argument immediately becomes invalid.mode_13h - Wednesday, July 28, 2021 - link

> If someone tells you to "reasearch" anything to support their argumentHe didn't. What he meant was for someone like a prof at a respected business school to do a thorough analysis of the organization, in order to understand how they've been so successful. This sort of thing happens, from time to time, and usually ends up in a best-selling book like those you can find about other massively successful companies in recent history.

Spunjji - Thursday, July 29, 2021 - link

That's an inference, not a law. Stating inferences as laws immediately invalidates your argument.mode_13h - Thursday, July 29, 2021 - link

> Stating inferences as laws immediately invalidates your argument.Good point, as usual.